Adam Khoo – Biography, Financial Summary, Career Overview

| Attribute | Information |

|---|---|

| Full Name | Adam Khoo Yean Ann |

| Date of Birth | April 8, 1974 |

| Nationality | Singaporean |

| Occupation | Entrepreneur, Author, Educator, Investor |

| Notable Companies | Adam Khoo Learning Technologies Group, Piranha Profits |

| Education | National University of Singapore |

| Estimated Net Worth | $150 million (approx. SGD 200 million) |

| Primary Income Sources | Course sales, educational ventures, investing portfolio |

| Investment Style | Deep value investor, large-cap brands |

| Link for Reference | Wikipedia – Adam Khoo |

Although Adam Khoo’s story is frequently characterized as one of metamorphosis, that term falls short of capturing the sheer determination that molded his rise to prominence. Khoo’s journey from being expelled from school as a teenager to creating a business empire that is reportedly valued at $150 million is not only inspirational, but it is also remarkably transparent in both its structure and its goal. His wealth has come from building a particularly creative ecosystem that monetizes financial education at scale, rather than just from high-stakes trading.

Khoo has honed his approach into a very effective one in recent years. His prior focus on forex trading was the target of early critics, but he has since shifted to long-term value investing. The content and credibility of this change, which focused on dependable, brand-dominant businesses, were noticeably enhanced. It separated him from the high-risk speculation frequently connected to early-stage trading gurus and brought him closer to the ideas of legendary investors like Warren Buffett.

He created a highly adaptable model through Piranha Profits and Adam Khoo Learning Technologies Group, which combines automated funnels, individualized coaching, and digital content. The expensive courses are made to distill decades of investment expertise into manageable modules. Even though some online forums are still dubious about the cost-benefit ratio, many have found them to be remarkably effective in laying the groundwork for understanding.

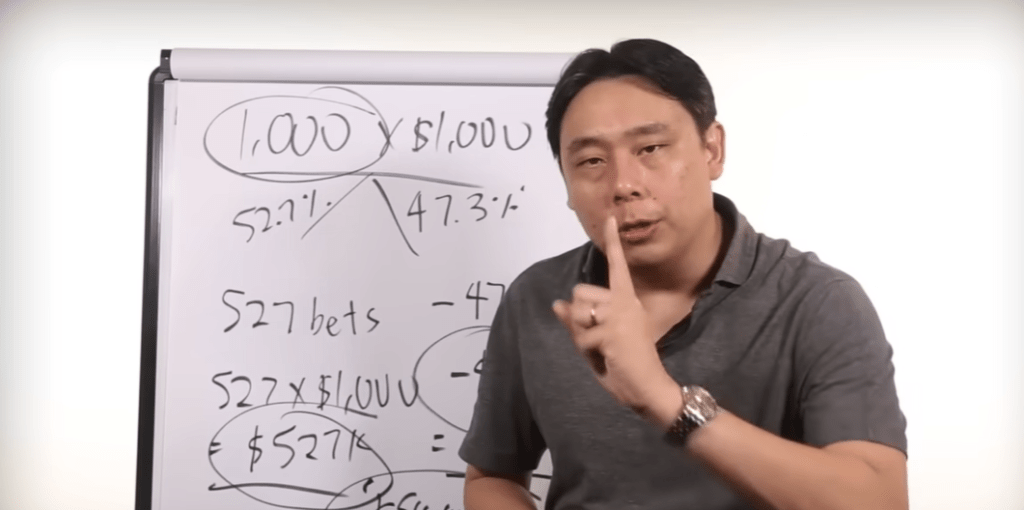

His YouTube channel, which currently has a sizable following, serves as a strategic lead generator in addition to an educational resource. Khoo has proven to be incredibly dependable at simplifying intricate financial subjects into easily understood formats thanks to this platform. He has increased his reach among audiences worldwide and added a reliable source of income by utilizing YouTube’s monetization and advertising tools.

Adam has continuously updated his course offerings by working with team members and content producers, which attracts and retains students. His reliance on erratic markets has been greatly diminished by the steady income from memberships and community-based business models. As global finance shifts toward self-learning models and passive wealth creation, that approach—which is based on consistency rather than speculation—has proven especially advantageous.

Notwithstanding previous disputes, such as Reddit posts casting doubt on his earnings distribution, the figures point to a well-run business. Although it is true that the majority of his wealth comes from selling courses rather than from personal trading, critics frequently point out that this fact highlights an entrepreneurial reality: selling valuable education is a business in and of itself. Adam’s newfound openness about this dynamic is what makes him unique.

His model stands out as being especially resilient in the context of digital entrepreneurship. Khoo has developed a sustainable brand that appeals to both novice and experienced investors, in contrast to those who use unsustainable trading strategies or shock-value marketing. He has achieved this by integrating revenue from speaking engagements and course subscriptions into a logical financial ecosystem.

Khoo’s businesses grew faster during the pandemic, when online learning was at its peak. His teachings on compounding wealth and financial freedom resonated as people reevaluated their financial and professional futures. He extended Piranha Profits into new markets, breaking into segments in Malaysia, India, and even some parts of Europe, thanks to strategic alliances and a solid team structure.

Adam Khoo’s portfolio will probably diversify over the next few years. He is making sure that his company’s development stays ahead of the curve by incorporating blockchain technology and AI-driven analytics into his platforms. Because of his focus on thought leadership, personal branding, and empirical investment principles, he is better equipped to handle market volatility.

In Singapore, the Khoo brand has also developed into a family symbol of upward mobility. His journey from underachieving student to multi-millionaire resonates across generations in a society that values education and entrepreneurship. As a living example of what adaptive thinking can accomplish, he is frequently asked to speak at finance summits and schools.

Adam Khoo’s path provides early-stage business owners with a blueprint in addition to financial benchmarks. He has shown that intellectual equity can be just as valuable as market returns by turning insight into influence and content into capital. His success also serves as an example of the emergence of the educator-entrepreneur, a person who exchanges knowledge for money and then uses that money to further their education.